Now you can PayLater

Suncorp Bank PayLater. No interest, pay in 4.

Easy to use, easy to pay.

No interest - make 4 equal fortnightly payments

No fees when you pay on time

Apply in minutes for a spend limit of $1,000

Shop with Visa Debit worldwide¥

Pay for it your way

Buy it now and pay it back in four easy payments.

- Use the Suncorp Bank PayLater Visa Debit card worldwide, in-store and online¥, for purchases of $50 or more, up to your spend limit of $1,000.

- When you make a PayLater purchase, we’ll immediately deduct 25% of the price from your linked Suncorp Bank Everyday Options Account,^ with three more equal automatic fortnightly payments to follow.

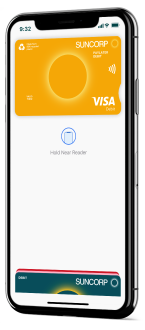

- Once approved, you can add your PayLater Visa Debit card to your phone’s digital wallet instantly.

- There are no account keeping fees and no foreign currency conversion fees when you use your PayLater Visa Debit card overseas or when shopping online.

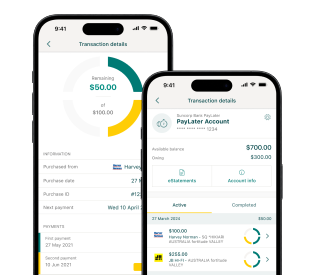

Track spending your way

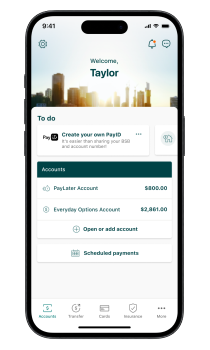

It all comes together in the Suncorp Bank App.

Download the latest version of the Suncorp Bank App to access all PayLater account features.

- Your PayLater purchases and payment schedules are all at your fingertips in the one App.

- You can make payments early at any time.

- You can even adjust your payment day to better suit your lifestyle.

Budget your way

Suncorp Bank PayLater is designed to help you stay on top of your payments.

- We’ll always send reminders when an automatic fortnightly payment is coming up.

- We know sometimes life can get a little hectic. If an automatic payment is missed because you don’t have enough funds in your linked account, you’ll have two more days to pay it manually before we charge a $10 late fee (which we hope to never do).

- Unlike some other ‘buy now, pay later’ options, Suncorp Bank PayLater late fees are capped at one late fee per purchase.

How PayLater works with an Everyday Options Account

To be eligible, the account:

- needs to be in your name (either solely or as a joint account with someone else)

- must not require more than one signature for withdrawals

- can not currently be overdrawn.

To get started with Suncorp Bank PayLater, you’ll need an eligible Suncorp Bank Everyday Options account.

All your PayLater payments will be deducted from this linked account.

Payments are automatic, so always ensure your Everyday Options Account has sufficient funds before making a PayLater purchase and whenever a payment is due.

You can:

- Use an existing eligible Everyday Options Account

- Open an Everyday Options Account when you apply for Suncorp Bank PayLater

It only takes a few minutes to open an Everyday Options Account. Once it’s open, you can continue your Suncorp Bank PayLater application straightaway.

With the Everyday Options Account you bank online, in branch and by phone plus you can spend, save and budget better with sub-accounts and flexiRates.ƒ

Benefits include:

- no monthly fees

- no foreign currency conversion fees on Visa Debit card† purchases online and overseas

- the option to lock in higher rates by setting aside savings in your Everyday Options Account with flexiRates

- the option to open up to 9 sub-accounts to help you budget and save.

We also offer other Everyday Accounts, but they’re not eligible to be linked to your Suncorp Bank PayLater account

Get started with PayLater

Before applying for a Suncorp Bank PayLater account, please read these important Terms and Conditions (PDF 100KB).

Everything you need to know about PayLater is in this document.

We’re here to help

Frequently asked questions

There are a few things you’ll need before you can apply for a Suncorp Bank PayLater Account, including an eligible Suncorp Bank Everyday Options Account which will be linked to your PayLater Account.

As long as the Everyday Options Account is in your name (either solely or as a joint account with someone else), doesn’t need more than one signature for withdrawals and is not currently overdrawn, it’s an eligible account.

To apply for a Suncorp Bank PayLater Account, you also need to be at least 18 years old, have your identity verified (you’ll need to supply your Australian Driver’s Licence details) and satisfy a credit check with a credit reporting bureau.

You can only have one PayLater Account at any one time, and it must be in your name only. We don’t offer joint Suncorp Bank PayLater Accounts, or accounts with secondary card holders.

No, there are no PayLater monthly fees and no interest charges on your purchases.

If an automatic payment doesn’t go through due to insufficient funds, you’ll have two more days to make it manually before we charge a $10 late fee. We’ll only charge one late fee per purchase. Learn more about Suncorp Bank PayLater late fees.

Of course! Just log into the Suncorp Bank App, tap through to select the PayLater payment and hit ‘Pay Now’.

As part of the PayLater application process, we’ll perform a credit check on you. We also report back to credit reporting agencies on your PayLater repayment history. If your PayLater payments are made on time, we tell the reporting bodies that. To have that on your file is very valuable and shows you can manage a credit facility. If you are late making payments or you have outstanding payments, we also report that information – and that can negatively impact your credit score and your ability to be approved for other credit facilities.

We’ll send reminders to make sure you’re aware when payments are due and when they’re overdue. To help us help you, please make sure your email and phone number are always up to date with us.

Our decision to not approve your PayLater application may have been based on the information we obtained in your credit file. It also could have been a result of us not being able to locate you with the credit reporting bodies, or from you requesting them to not release your information.

To help you determine if your credit history was contributing to our decision, you can request a copy of your credit file. If you make an access request with Equifax within 90 days of a declined notification, they will provide the information they hold with you at no cost to you. We recommend you check your credit reporting information to ensure it is an accurate reflection of your circumstances.

To make an access request from Equifax, visit mycreditfile.com.au

To contact Equifax, visit Equifax.com.au/contact

You also have the right to access and seek correction of personal information (including credit information and credit eligibility information) that we hold about you. For further details, view Suncorp Bank’s Credit Reporting Policy (PDF).

We understand things don’t always go to plan. Lost your job, been unwell, reduced work hours. There are plenty of reasons why your budget can be turned upside down. We won’t know you are having trouble unless you let us know.

If you’re unable to meet your financial commitments for any reason – or you’re expecting you’ll experience financial difficulty soon – we’re here to help.

Please contact us as soon as possible on 1800 225 223 (8:30am–5pm, Mon-Fri, AEST) or submit a request for assistance. Our Customer Assist team can help you get the support you need.

You might also consider contacting a financial counsellor to discuss your situation. Some financial counsellors provide free and confidential service, and may be able to assist you to overcome financial difficulty. Learn more about accessing financial counselling and other resources that can help.

Things you should know

Home Loan, Personal and Business Banking products are issued by Suncorp Bank (Norfina Limited ABN 66 010 831 722 AFSL No 229882 Australian Credit Licence 229882) to approved applicants only. Eligibility criteria, conditions, fees and charges apply and are available on request. Please read the relevant Product Information Document and terms and conditions before making any decisions about whether to acquire a product.

^ 25% of the purchase price must be available in your linked Everyday Options Account at the time of purchase for the transaction to be approved.

¥ Suncorp Bank PayLater cannot be used for purchases from merchants classified under the gambling merchant category codes, or ATM usage.

† A Suncorp Bank Visa Debit Card is required. Suncorp Bank Visa Debit Cards are not available to overseas residents, Trustee accounts, accounts where the number to sign to operate is two or more (no form of card access is allowed) or a child under the age of 11. Suncorp Bank Visa Debit Cards must have an account linked as Primary Credit Relationship. Each customer may only have one Suncorp Bank Visa Debit Card per Primary Credit account.

ƒ flexiRates allows you to earn higher interest rates by locking away a portion of your savings within your account for periods up to 12 months. flexiRates can only be opened and accessed online.

Apple, the Apple logo, Apple Pay and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries and regions.

App Store is a service mark of Apple Inc.

Google Wallet, The Google Wallet logo, Google Pay, The Google Pay logo, Google Play and the Google Play logo are trademarks of Google LLC.

Android is a trademark of Google LLC.

To be eligible, the account:

- needs to be in your name (either solely or as a joint account with someone else)

- must not require more than one signature for withdrawals

- can not currently be overdrawn.